The world of options trading beckons with captivating whispers of exponential gains and market mastery. But amidst the glittery allure lies a labyrinth of complexity, shrouded in volatility and risk.

So, what separates the triumphant traders from the fallen warriors?

The answer lies in a potent blend of strategic prowess, analytical aptitude, and unwavering discipline—the top traits of successful option traders.

Mastering the Dance of Risk:

The delicate art of options trading revolves around leverage, a double-edged sword amplifying both profits and losses. Successful traders understand this inherent risk and meticulously manage it through position sizing.

They allocate capital proportionally, ensuring even a bad trade won’t topple their financial fortress. Furthermore, they pre-define stop-loss orders, acting as emotional circuit breakers that automatically exit losing positions, preventing catastrophic plunges.

Position Sizing: The Art of Measured Bets

Imagine the trading floor as a casino chip roulette, but instead of betting on red or black, you’re placing chips on complex financial instruments. Successful traders understand they can’t pile all their chips on one number in this game.

Position sizing is their strategic way of spreading their bets, ensuring a single bad spin doesn’t leave them empty-handed.

- The 1% Rule: A common starting point is the 1% rule, where you risk no more than 1% of your capital on any single trade. This conservative approach protects your overall portfolio during inevitable market fluctuations.

- Tailoring the Risk: Adjust the risk percentage based on your experience, market volatility, and the specific option chosen. Higher volatility or complex strategies might warrant a smaller percentage allocation.

- Dynamic Adjustments: Don’t treat position sizing as a static rule. As your portfolio grows or market conditions change, recalibrate your risk tolerance and adjust your bets accordingly.

Stop-Loss Orders: Your Emotional Circuit Breaker

Fear and greed can cloud judgment, leading to impulsive decisions and potentially disastrous losses. Stop-loss orders are your automated security guards, pre-defining your exit point based on a maximum acceptable loss for any given trade.

- Setting the Right Level: Don’t place stop-losses too close to your entry point, giving the market room to breathe. Analyze chart patterns and volatility to set realistic levels that protect your capital without hindering potential profits.

- Trailing Stops: As your winning trade progresses, consider using trailing stop-loss orders that adjust dynamically based on market movement. This helps lock in profits while still leaving room for further gains.

- Discipline is Key: Resist the temptation to tamper with your stop-loss orders once set. Remember, they’re there to protect you from your own emotional biases, not to be overridden by impulsive reactions.

Understanding Leverage – Respecting the Market’s Amplifier:

Options amplify both gains and losses, making them a potent tool but also a double-edged sword. Successful traders respect the power of leverage and wield it with calculated precision.

- Know Your Delta: Delta measures the rate of change of an option’s price relative to the underlying asset’s price. Understanding delta helps you anticipate potential profits and losses, allowing you to tailor your position size and risk accordingly.

- Volatility Matters: Higher volatility means faster and larger price swings, magnifying both potential gains and losses. Adjust your leverage and risk exposure based on the market’s current volatility, staying cautious during turbulent times.

- Hedging for Protection: Consider hedging strategies to mitigate risk by using multiple positions that offset each other’s losses. This can involve taking opposing positions in options or the underlying asset to create a more balanced portfolio.

Mastering the dance of risk is not a one-time feat, but an ongoing process of analysis, adjustment, and adaptation. By understanding and implementing these fundamental principles, you can approach options trading with a healthy respect for the market’s power and a strategic plan to navigate its complexities.

Remember, patience, discipline, and a measured approach are your keys to navigating the dance floor of risk with grace and confidence.

Demystifying the Market Matrix:

Successful traders aren’t mere gamblers; they’re market detectives. They delve into economic data, analyze industry trends, and decipher the whispers of news headlines. With technical analysis, they become chart whisperers, identifying patterns and trends using indicators like moving averages and MACD.

But their arsenal doesn’t stop there. They master the cryptic language of the Greeks, understanding how delta, gamma, theta, and vega influence option prices and behave under market pressure.

Strategizing for Success:

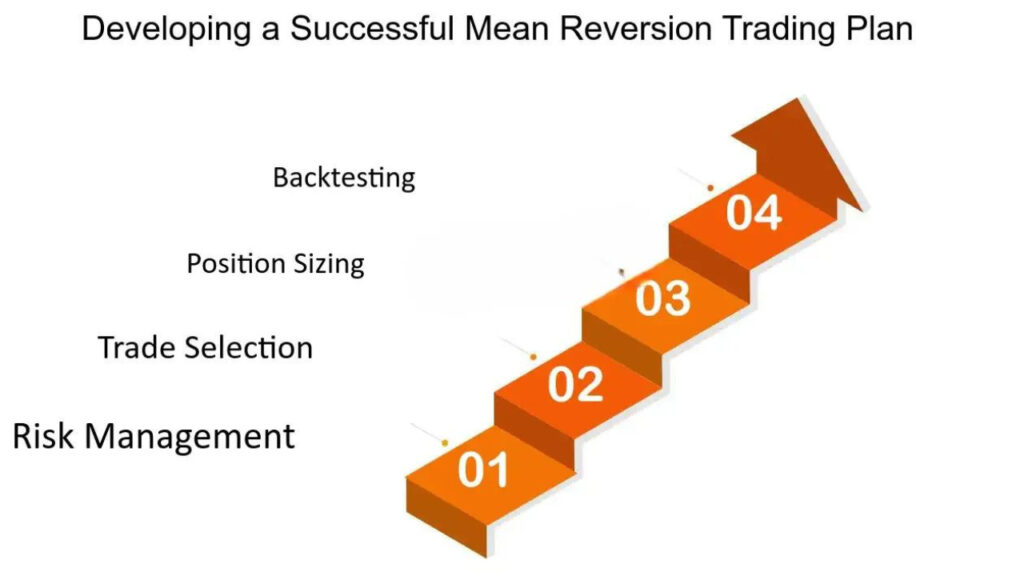

Victory in options trading lies not in impulsive reactions, but in calculated moves guided by a predefined trading plan. This roadmap outlines goals, risk parameters, and the specific strategies best suited for their risk tolerance and market understanding.

Successful traders cultivate patience, waiting for the optimal entry and exit points dictated by their plan, not the siren song of emotions. But they also recognize the market’s fluidity, remaining adaptable and evolving their strategies as conditions shift.

Taming the Emotional Beasts:

Fear and greed, the primal twins of human emotions, wreak havoc in the trading arena. Successful traders, however, recognize these beasts and keep them caged. They cultivate objectivity, analyzing the market with a clear head, unclouded by emotional biases. When losses arrive, they don’t wallow in despair; they see them as stepping stones, analyzing errors and learning from the market’s lessons.

The Never-Ending Quest for Knowledge:

Successful traders are insatiable learners. They devour market research, staying abreast of economic news, industry trends, and the evolving regulatory landscape. They backtest their strategies, using historical data to refine their approach and identify weak spots before risking real capital.

And they seek mentorship from experienced traders and financial experts, gleaning wisdom from those who have already navigated the market’s treacherous waters.

Reaching the Promised Land:

Forging a successful path in options trading demands unwavering dedication and continuous learning. The traits outlined here are not mere suggestions; they’re the blueprint for navigating the market’s treacherous currents and reaching the shores of consistent profitability.

So, aspiring traders, arm yourselves with this knowledge, temper your emotions with discipline, and embark on your own journey into the labyrinth of options trading. Remember, the path may be demanding, but the rewards, if conquered, are truly boundless.

Bonus Material:

- Consider including real-life examples of successful traders who embody these traits.

- Add quotes from renowned financial experts emphasizing the importance of discipline and risk management.

- Provide a resource section with suggested books, websites, and educational materials for further learning.

By incorporating these suggestions, you can transform your article into a comprehensive and compelling guide for aspiring option traders, empowering them to navigate the market with confidence and build a foundation for long-term success.

I hope this detailed draft meets your expectations and helps you complete your informative and inspiring article!