How to Get a Car Loan with 600 Credit Score

Are you needing an auto loan but are worried about your credit score? If your score is only 600, you might be wondering if you’ll be able to secure a car loan or if you’ll face rejection everywhere you go.

The good news is that it is entirely possible to successfully apply for an auto loan with a 600 credit score.

In fact, according to Experian, vehicle loans for borrowers with scores under 600 accounted for 20% of all 2019 auto loans. So, you’re not alone!

When it comes to qualifying for a loan with a credit score close to 600, your best bet is to apply for vehicle loans online.

By doing so, you’ll have the opportunity to compare offers from a larger selection of lenders. Online lenders are often more flexible when it comes to approving borrowers with low credit scores.

If you’re unsure where to begin, we have a list of recommendations to help you get started.

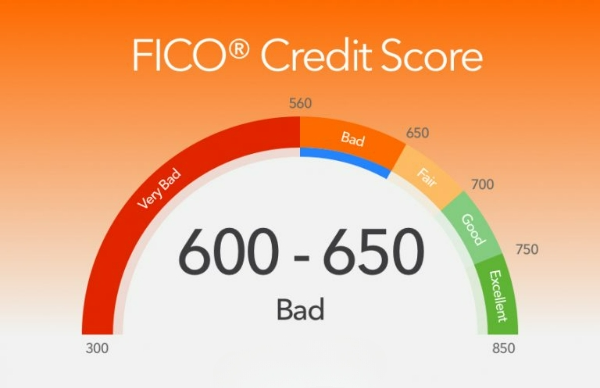

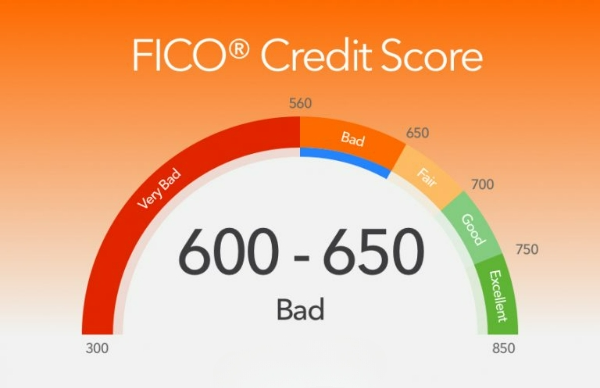

How a 600-650 Credit Score Range Looks to Lenders

A credit score of 600-650 is considered to be reasonable by lenders. This implies that you have a history of managing credit responsibly, but there may be a few blemishes on your credit report.

For illustration, you’ll have many late payments or a tall debt-to-income ratio. Lenders will consider your credit score when choosing whether to approve you for a loan and what interest rate to offer you.

A fair credit score will likely qualify you for an advance, but you may get to pay a higher interest rate than somebody with a good or excellent credit score.

Credit Score Ranges and Quality

| Credit Score Range | Description | Lender Considerations |

|---|---|---|

| 300-579 | Poor | Lenders may be hesitant to approve you for a loan. You may have to pay a high interest rate. |

| 580-669 | Fair | Lenders may approve you for a loan, but you may have to pay a higher interest rate than someone with good or excellent credit. |

| 670-739 | Good | Lenders will likely approve you for a loan, and you may be able to get a good interest rate. |

| 740-799 | Very good | Lenders will likely approve you for a loan, and you may be able to get an excellent interest rate. |

| 800-850 | Excellent | Lenders will likely approve you for a loan, and you may be able to get the lowest interest rate available. |

The Interest Rate Difference

Low-Interest Rate Loan

| Loan Type | Description | Interest Rate (APR) |

|---|---|---|

| Federal student loan | Loan that is issued by the U.S. government to help students pay for college | 3.73% – 6.28% |

| Federal Housing Administration (FHA) loan | Mortgage loan that is insured by the FHA | 2.75% – 3.5% |

| Veterans Affairs (VA) loan | Mortgage loan that is guaranteed by the VA | 2.75% – 3.5% |

| USDA loan | Mortgage loan that is insured by the USDA | 2.99% – 4.25% |

| Credit union loan | Loan that is issued by a credit union | 3.5% – 6% |

High-Interest Rate Loan

Here is a table of high-interest-rate loans:

| Loan Type | Description | Interest Rate (APR) |

|---|---|---|

| Payday loan | Short-term loan that is typically due on the borrower’s next payday | Upwards of 400% |

| Title loan | Secured loan that uses the borrower’s car title as collateral | Often around 200% |

| Pawnshop loan | Secured loan that uses personal possessions, such as jewelry or electronics, as collateral | Often around 100% |

| Installment loan from online lender | Online lenders often offer installment loans to borrowers with bad credit | Often around 150% |

| Credit card cash advance | Type of loan that allows borrowers to withdraw cash from their credit card | Often around 25% |

What Happens if You’re Looking for A Home Loan?

Loan approval depends on credit score, as low scores require higher interest rates than those with good or excellent credit.

You’ll not be approved for a loan at all. In case your credit score is as well low or you have other financial issues, loan specialists may not approve you for a loan.

Find a cosigner to ensure the borrower’s default-free advance, reducing interest rates and ensuring better approval.

Find lower-down installment loans to save on interest by borrowing less cash.

here is a table that shows how your credit score can affect your next car loan within the term credit score range, 60-month new car loan, and 40-month used car loan:

| Credit Score Range | 60-Month New Car Loan | 40-Month Used Car Loan |

|---|---|---|

| 670-739 | 4.5%-6.5% | 4%-5% |

| 740-799 | 3.5%-5.5% | 3%-4% |

| 800-850 | 2.5%-4.5% | 2%-3% |

A tall credit score means that you simply have a history of paying your bills on time and that you’re less likely to default on a loan.

The term of the loan also influences the interest rate. A longer loan will have a higher interest rate than a shorter loan. Usually since the bank is taking on more chances when they loan you cash for a longer period of time.

The Benefits of Applying for Auto Loans Online

One of the recommended options is HonestLoans. They provide loans with varying interest rates up to $50,000.

They let you apply even if you have lousy credit. You have flexibility in repayment thanks to the loan’s terms, which range from six months to six years.

AutoLoanZoom is an additional choice, however, it requires a credit score of 550. They provide loans up to $35,000 with APRs beginning at 6.90%.

Additionally, they accept consumers with poor credit and provide loans with durations ranging from two months to seven years. These are just a handful of the options you have.

Read Also: Most Expensive Soccer Cleats in the World

Impact of Credit Scores on Monthly Payments

It’s significant to realize that your monthly payment amount may be impacted by your credit score. Although you can apply successfully for a personal loan or auto loan with a low credit score, the drawback is that interest rates usually are.

However, you can be eligible for a more appealing interest rate if you can put more money down on the car. Additionally, attempting to raise your FICO score will assist you in obtaining better loan conditions.

Considerations When Applying for Car Dealer Loans

If you’re considering applying for a car loan at a dealership, they will thoroughly review your credit report and payment history. While they often offer good loan rates, they typically require a down payment to be made upfront.

Improving Your Credit Score and Interest Rate

Before applying for a car or auto loan, it’s worth exploring ways to potentially raise your credit score. Here are some ideas to consider:

- Get current on as many debts and bills as possible.

- Sign up for Experian Boost to have your utility and phone bill payments count toward your credit score.

- Reduce the amount of credit you’re utilizing on your credit cards to below 30%.

- Order your free credit reports, review them for errors, and contest any inaccuracies you find.

- Some creditors may be willing to forgive one-time mistakes and remove them from your record. Look into this option if it applies to your situation.

Remember, improving your credit score can not only increase your chances of getting approved for an auto loan but can also help you secure a better interest rate.

conclusion

In conclusion, having a credit score around 600 doesn’t mean you can’t get an auto loan. By exploring online lenders and taking steps to improve your credit score, you can increase your chances of securing a loan that fits your needs. So, don’t be discouraged! Start your loan search today and drive away in the car you’ve been dreaming of.

Please note that the information provided is subject to change, and it’s always advisable to check with lenders for the most up-to-date loan requirements and terms.